What is a payment service provider (PSP)? A guide & examples

In today’s digital age, the ability to conduct transactions online has become not just a convenience, but a necessity for businesses worldwide. At the heart of this financial ecosystem is the Payment Service Provider (PSP), a critical facilitator for both businesses and consumers looking to navigate the digital marketplace with ease and security. But what exactly is a PSP, and how does it benefit your business? Let’s dive into the world of payment service providers to uncover their pivotal role in modern commerce.

What is a Payment Service Provider (PSP)?

A Payment Service Provider acts as a mediator between merchants and the financial institutions involved in a transaction. PSPs enable businesses to accept various forms of electronic payments, including credit and debit cards, bank transfers, and an expanding array of alternative payment methods. By simplifying the payment process, PSPs help merchants expand their reach, improve customer satisfaction, and secure transactions against fraud.

The journey from clicking ‘pay now’ to the confirmation of payment involves several steps, all seamlessly handled by the PSP. This process not only ensures the security of sensitive financial information but also streamlines the transaction for a swift and satisfactory customer experience.

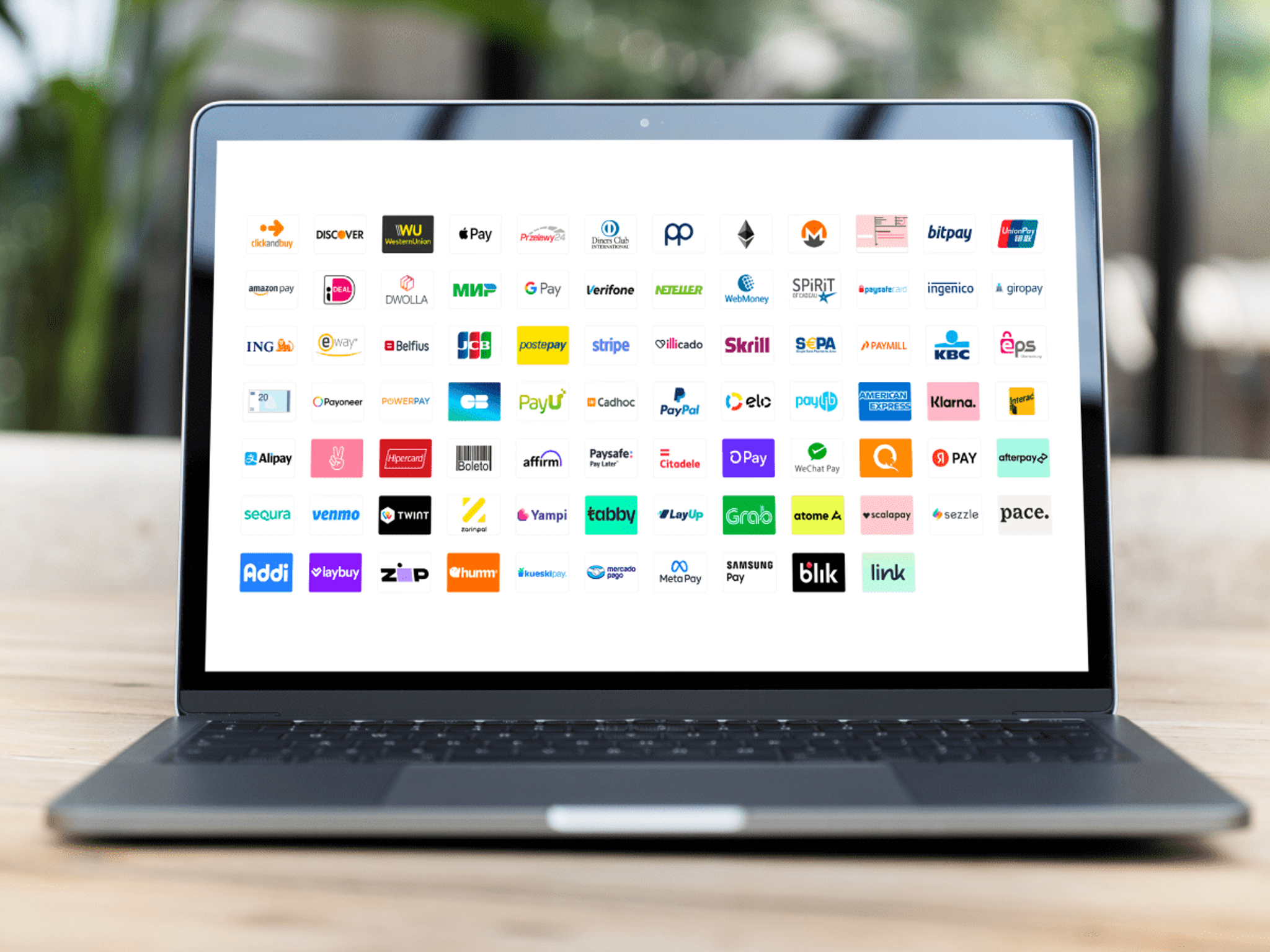

Top Payment Service Providers for 2024 – List of Examples

The payment service provider landscape is dynamic, with several key players offering innovative solutions to meet the evolving needs of businesses and consumers alike. As we move into 2024, here are the top payment service providers, each distinguished by its unique strengths and offerings:

- Authorize.net: Authorize.net is a veteran in the field, handling over 1 billion transactions per year. Known for its reliability and comprehensive suite of services,making it a solid choice for businesses of all sizes.

- PayPal: Renowned for its ease in sending and receiving payments, PayPal continues to dominate as the world’s most widely used payment acquirer. It offers flexibility and a broad acceptance that’s hard to match.

- Google Pay: Distinguished for storing multiple payment methods, Google Pay allows users to make payments seamlessly through their Google profiles without any transaction fees. It stands out for its convenience and integration with other Google services.

- Stripe: Best known for its customization capabilities, Stripe provides a flexible platform that boasts a wide array of tools and plugins, catering to businesses looking for tailored payment solutions.

- Shopify Payments: Tailored for ecommerce stores, Shopify Payments integrates directly with Shopify store, streamlining the payment process. It requires an active Shopify plan.

Top payment service providers in Poland:

- PayU: The most popular online payment service in Poland, used by 43% of respondents for online purchases in 2023.

- Przelewy24: A leading Polish payment service provider that allows merchants to accept various payment methods like bank transfers, cards, and e-wallets.

- Dotpay: One of the oldest and largest PSPs in Poland, offering credit/debit cards, bank transfers, e-wallets, and other payment options.

- Tpay: A popular payment gateway that supports bank transfers, cards, and mobile payments.

- BlueMedia: A payment service provider that enables merchants to accept bank transfers, cards, and mobile payments.

As businesses continue to navigate the complexities of the digital marketplace, these payment service providers offer a range of solutions to enhance transaction efficiency, security, and user experience. When selecting a PSP, consider factors such as pricing, features, and the specific needs of your business to ensure the best fit for your payment processing requirements.

Online Payment Providers – What Are Their Benefits?

Implementing a PSP into your business model comes with numerous advantages. Enhanced security measures protect against fraud, while the convenience of multiple payment options can boost customer satisfaction and conversion rates. Moreover, PSPs enable businesses to tap into international markets by accepting various currencies and payment methods, broadening their customer base and potential revenue streams.

Implementing Digital Payment Service Providers in Your Business

PSP integration requires careful consideration of the unique needs of your business and customers. Start by estimating the average transaction size, determine what payment methods are most popular with your customers, and consider international transaction requirements. The integration process itself will vary from vendor to vendor, but generally includes technical configuration, compliance checks with financial systems, and UX/UI process design. By following the best practices from case studies from selected PSPs, you can ensure a seamless integration of digital payments on your platform, increasing operational efficiency and customer satisfaction.

Boost your e-commerce with 300.codes

As you can see, implementing a PSP is a challenge worth tackling. It is better to embark on such a dangerous journey with a guide. At 300.codes, we have specialized in modern e-commerce solutions for years. We won’t just help you integrate digital payment services – we can also conduct an expert audit of the entire platform you’re selling from to suggest optimizing it for conversion and speed, or even create an e-store completely from scratch. Want to strengthen your online presence, streamline your online transactions and maximize your sales potential? Let’s talk!